GST law has covered all the professional services under its tax umbrella, irrespective of the nature of the service whether it is provided by Chartered Accountants, Company Secretaries, Cost Accountants, Engineers, Lawyers, Technical Consultants, Architects, Interior Decorators, Film Directors, Cameramen, Artists, Singers, Authors, IT Professionals or Doctor.

Who is required to register?

GST Registration is mandatory for any professional whose turnover in a financial year exceeds Rs.20 lakhs (Rs.10 lakhs for North Eastern and hill states). This brings us to a very pertinent question – Who is a professional?

The term “professional” is not defined in the GST Act. But, in general parlance it means “an occupation, practiced by someone who has undergone training and/or a formal qualification”

Time limit for GST Registration

Section 25(1) of the act states that every person who is liable to be registered shall apply for registration in every such State, where he is liable, within 30 days from the date he becomes liable for registration.

Valuation of taxable services

Once your GST registration is done, the next step is to understand the valuation under GST. Valuation plays a very important role under GST because valuation helps in determining the correct value on which GST can be applied.

When you should pay GST

The time of supply is the point in time when goods/services are considered supplied. CGST/SGST or IGST must be paid at the time of supply.

Time of supply of services is earliest of:

1. Date of issue of invoice

2. Date of receipt of advance/ payment.

3. Date of provision of services (if invoice is not issued within prescribed period)

The GST payment shall be made with in 20th of next month.

Invoicing under GST

In general scenario invoice should be raised within 30 days of supply of service.

It is very important to bill the customer with GST amount in prescribed invoice format, else the supplier will have to bear the GST liability and other penal consequences for the services provided.

Filing of Returns Under GST

Once the registration is done, monthly, quarterly and annual filings are required depending upon the facts of the particular case. Major relevant GST forms are GSTR 3B, GSTR 1 etc.

Small tax payers with turnover less than Rs.5 crores can opt quarterly filing. The facility for opting into Quarterly return filing must be made at the beginning of the year.

In this option tax payers pay GST monthly and file return quarterly. This option helps the tax payer to reduce compliance cost and procedures.

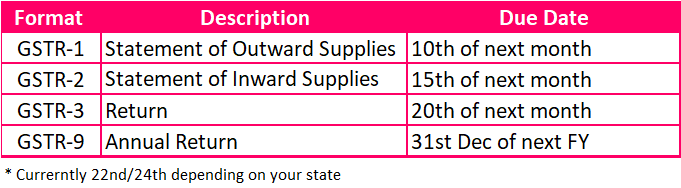

Types of Return and the due date

Let’s try to understand this with an example. Mr. Lal, an artist performed in a concert on 15th Sep 2019.The invoice for the same was issued on 1st Oct 2019 by him. However, the payment was received in advance on 1st Aug 2019. Here Mr. Lal issues the invoice with in the prescribed time limit of 30 days and hence the time of supply is the earliest of invoice date and receipt date i.e. 1st Aug 2019. The due date for making the GST payment and filing GST Return is 20th Sep 2019.

Rate of GST

The current rate of tax under GST is 18% for all categories of professionals in India except some specific exemptions provided for healthcare services. These professionals need to get themselves registered under GST laws, collect GST @ 18% on their invoices and deposit the same to the Government treasury, after adjusting allowed set offs, if any.

Documents Required For GST Registration

The following documents are required to register under GST .

- PAN

- Photo

- Address Proof

- Address Proof of Office

- NOC if Office is on rent

- Mobile No. and Email ID

Other important points to keep in mind

Compliance: A professional registered under GST, will have to upload all invoices to the GSTN. This means every transaction will also have to be invoiced.

Format of Invoice under GST: Taxpayers will have to raise invoices and bills in the correct format laid down by the GSTN. Debit and credit notes will also have to be maintained along with books of accounts in the approved format.

No Composition scheme for professionals: Professionals cannot apply for composition scheme as it is not available to any service providers except restaurant services. Composition scheme is the benefit extended to all small businesses/service providers who have a turnover of less than Rs.1 crore.

Maintenance of Proper Books: Under the GST Act, professionals providing services are required to maintain records and particulars of supplies where input tax availed and output tax paid invoices should be retained for a minimum period of 6 years from the due date of furnishing of annual return for the relevant year.

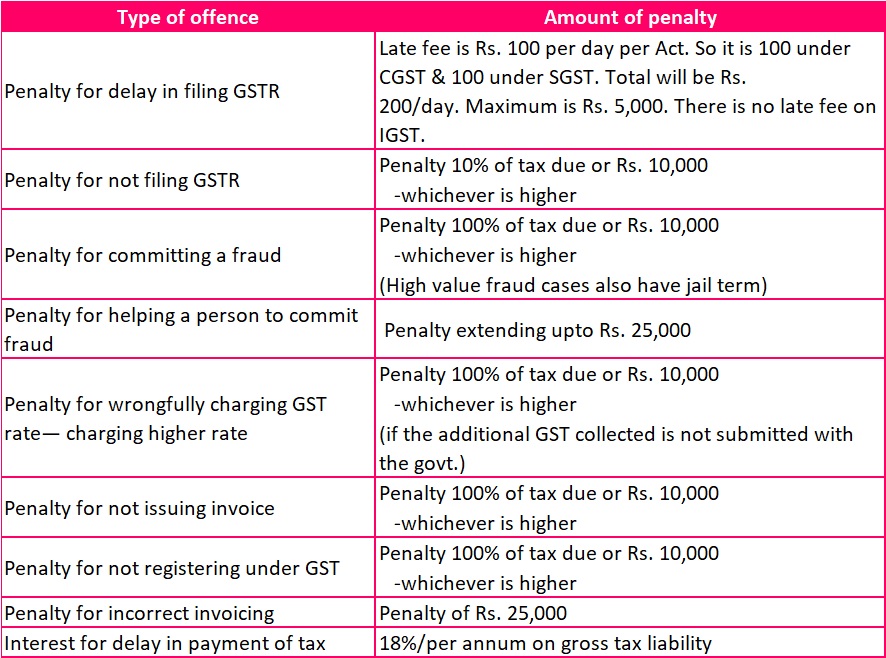

Offences and Penalties Under GST at a glimpse

Talk to our Tax experts today to ensure that you are compliant with the GST regulations and avoid penalty.

3 replies on “GST For Professionals In A Nutshell”

Easy to understand… Good job.. Expecting more from you like this…

Liked the way you presented. Explained in simple words.

great job…!!!!

Long way to go..!!!

Well explained ✌